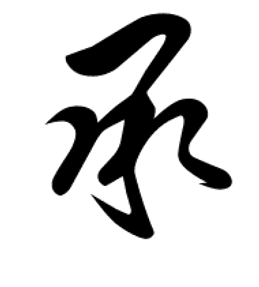

Business Legacy

The Key Essence for Successor

Transition & Business Continuity

Sudden loss of the keyman can be catastrophic to the company both operation and financial stability. Ensure your ultimate legacy remains your crowning achievement. Even after your lifetime. Business Succession Planning is lengthy and complex, but it has its rewards - stability and security for your family, the continuation of an enterprise, the advancement of your goals and your own peace of mind.

IMPORTANCE OF KEYMAN INSURANCE

1. Business Continuity

It protects against business risk in the event of unfortunate death of the key person.

2. Tax Savings

The premium paid would allow the company to save their company's tax .

3. Cash Flow & Credit Line

Disruption of lines of business credit due to the death of the Keyman can seriously affect the business.

4. Internal Stability

The morale of the key employee is boosted. He/she feels important. The sense of belonging increases productivity and helps in retention of the key employee.

5. Protect Company's Valuation

It protects the company's valuation in the event of Buy-Sell Agreement.

SOURCE: UOB Small Business Survey 2014

SUMMARY

Keyman insurance protects the company’s financial interest and ensures its survivorship. It injects capital - instant cash flow into the company and enhances its liquidity position.The cash flow in the business cycle may change and as a result, the business might have liquidity issues, leading to forced selling and even more financial losses. Also, the insurance premium for keyman insurance may qualify for tax relief if it fits the conditions set by the Inland Revenue Authority of Singapore.

KeyMan Insurance / Director & Officer's Liability Protection

Directors & Officers Liability (D&O liability Insurance) provides your directors and officers with personal liability and financial loss coverage from wrongful acts committed, or allegedly committed. Private companies must ensure they are compliant with the legal framework relevant across their entire operations – this includes careful management of their professional relationships with employees, creditors, customers and suppliers.

Is It necessary for SMEs enterprise to be protected with D&O Insurance ?

Many SME directors and senior management are aware of their exposure to unlimited financial & credit liabilities but just are not aware of the solutions to it. This resulted to placing themselves and the company at risk - gambling with luck during their daily operations.

The same laws and regulations apply to companies regardless large or small, so Directors of SMEs have the same level of responsibility as those of larger or public companies. Claims can arise from many areas of your commercial operations. Therefore, a prudent company should ensure that D&O insurance is a mandatory protection, because in many cases the director of a company will be the one held responsible, even if the mistake was not solely yours. By overseeing a company, you are not only responsible for the day-to-day action you made , but for those of your employees as well.

KEY RISK EXPOSURE

-

Vulnerability to shareholder/stakeholder claims

-

Sexual harassment, discrimination allegations and other employment practice violations

-

Accounting irregularities

-

Exposures relating to mergers and acquisitions

-

Corporate governance requirements , Regulatory investigations.

-

Misrepresentation in a prospectus

-

Creditors' claims

-

Company insolvencies

-

Competitor's claims / Defamation

-

Internal legal pursuit

-

Product patent rights